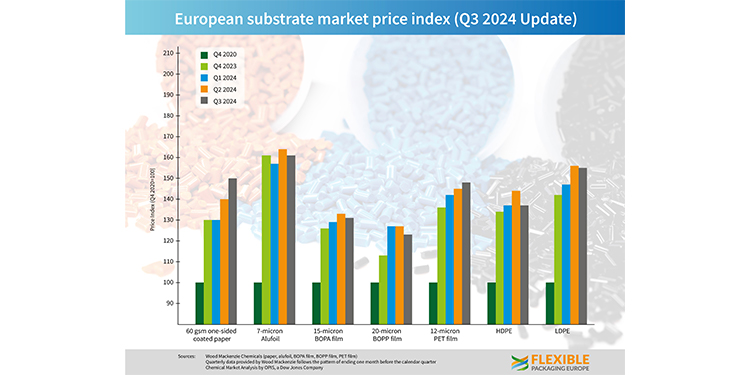

Prices for flexible packaging materials in Europe showed a mixed development in the third quarter of 2024, influenced by fluctuations in the availability of raw materials, logistics and international markets. The latest price index data (based on Q4/2020 = 100%) illustrates the dynamic changes in the individual substrates.

In the third quarter of 2024, the price of 60 g/m² one-side coated paper rose further to 150% compared to the base price, which corresponds to a significant increase compared to the previous quarters (Q1: 130%, Q2: 140%). Prices for aluminium foil (7 micron) showed a stable development at a high level (161% in Q3), following a high of 164% in Q2. In contrast, prices for 12-micron PET film continued to rise, reaching 148% in Q3.

A similar trend was observed for 15-micron BOPA film, the price of which fell slightly from a high of 133% in Q2 to 131% in Q3. 20-micron BOPP film also fell from 127% to 123%. Prices for HDPE and LDPE showed a stable to slightly declining trend. While HDPE fell from 144% in Q2 to 137% in Q3, the price of LDPE remained almost stable at 155% (after 156% in Q2).

Santiago Castro from Wood Mackenzie commented on the figures as follows: “Prices paid in Europe for flexible packaging materials varied in Q3 2024, driven by price fluctuations in raw materials, logistics and offshore markets. BOPP, BOPA, and Alufoil experienced slight price reductions due to declines in raw materials. BOPET prices increased due to higher freight costs, while paper prices experienced rises due to higher pulp costs, which have been attributed to stronger demand. Flexible packaging demand continued to increase in Q3. The increase was mainly organic but partly due to some restocking. However, stocks continue to be low across most converters. Prices are expected to remain stable for most substrates during Q4, besides paper, which is expected to see further increases. “

Guido Aufdemkamp, Executive Director of FPE, summarises the developments as follows: ‘Demand for flexible packaging was strong in the third quarter, driven by organic growth and partly by repeat orders. We expect the stabilising demand to continue in the next quarter. The rather subdued overall economic development in Europe and ongoing global tensions are leading to fragile consumer demand, meaning that concrete predictions are becoming increasingly difficult and imprecise for all market participants. In general, manufacturers of flexible packaging are cautiously optimistic about volume demand in the coming year.